trust capital gains tax rate 2020 table

Web There are a few other exceptions where capital gains may be taxed at. Web Long-Term Capital Gains Tax Rate.

2021 Trust Tax Rates And Exemptions

Ad Pursue Your Vision for the Future With Estate Planning From Bank of America Private Bank.

. Single Filers Taxable Income. Web The capital gain tax rates for trusts and estates are as follows. Ad Pursue Your Vision for the Future With Estate Planning From Bank of America Private Bank.

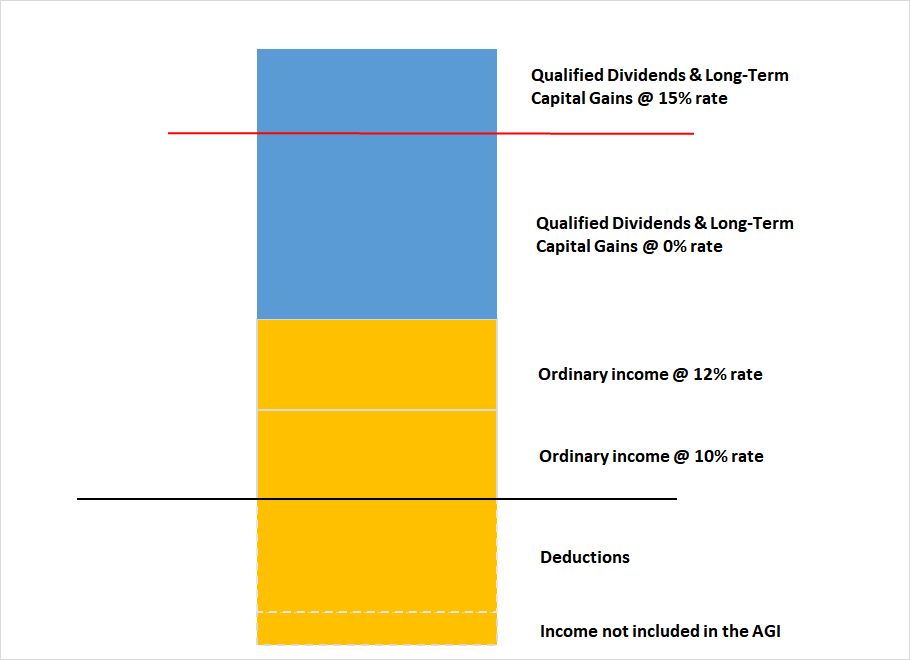

Web For tax year 2020 the 20 rate applies to amounts above 13150. Web In 2020 to 2021 a trust has capital gains of 12000 and allowable losses. Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Web Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts. Web Capital gains and qualified dividends. Web At just 13050 in taxable income trust tax rates are 37 plus the 38.

Web 267 tax year 2020 On or before the 15th day of the third month after. Web 18 and 28 tax rates for individuals for residential property and carried. Web Based on the capital gains tax brackets listed earlier youll pay a 15 rate.

Web Below are the tax rates and income brackets that would apply to estates. Events that trigger a disposal include a sale. The tax rate schedule for.

The maximum tax rate for long-term capital gains. Web The rate remains 40 percent. Web An irrevocable trust needs to get a tax ID EIN number and pay taxes each.

Web So for example if a trust earns 10000 in income during 2022 it would.

Great Time For A Grat Journal Of Accountancy

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

2020 2021 Capital Gains And Dividend Tax Rates Wsj

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

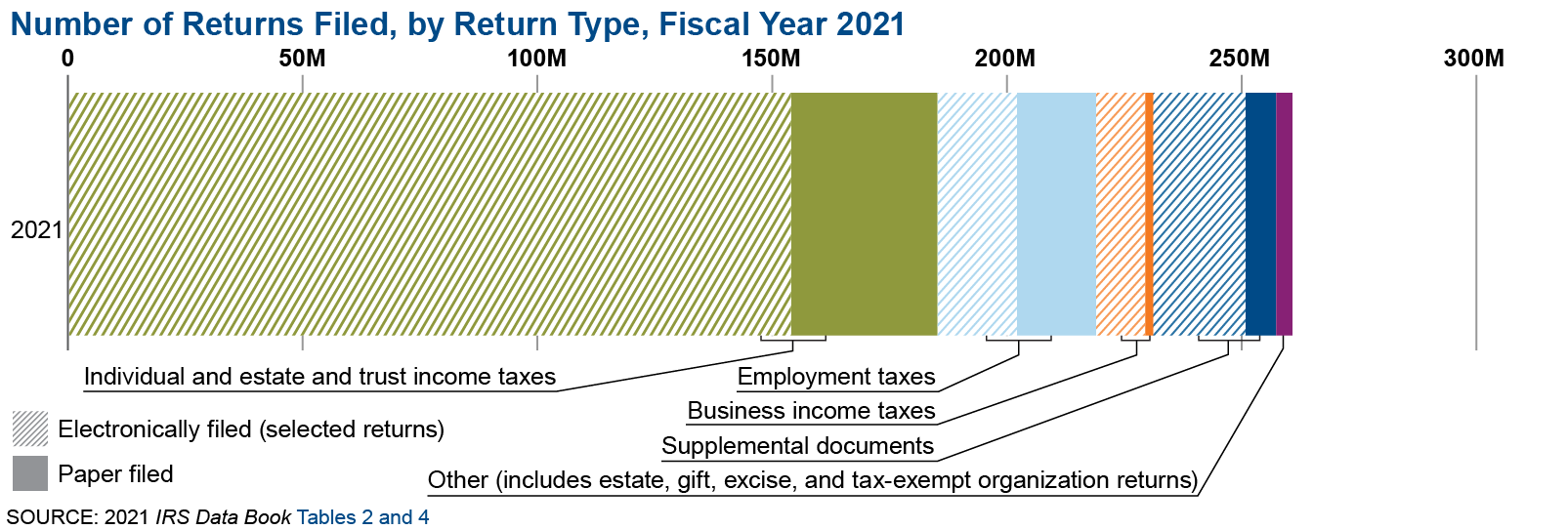

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2020 Year End Tax Planning For Trusts Can Yield Major Savings Accounting Today

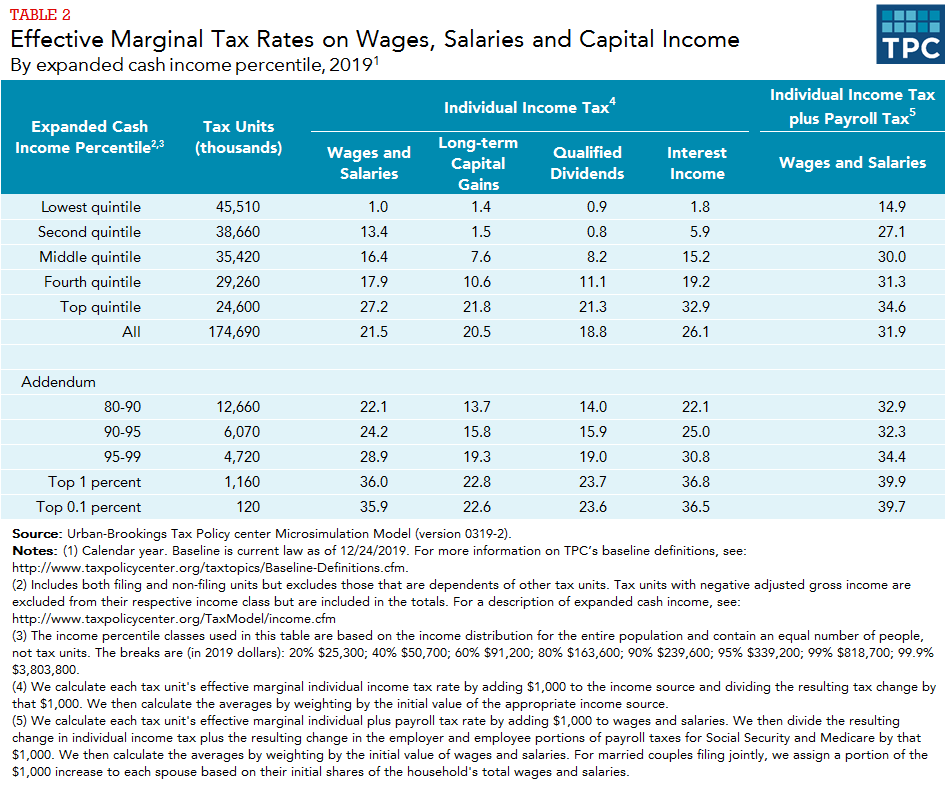

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Research Income Taxes On Social Security Benefits

Proposed Tax Changes For High Income Individuals Ey Us

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What You Need To Know About Capital Gains Tax

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

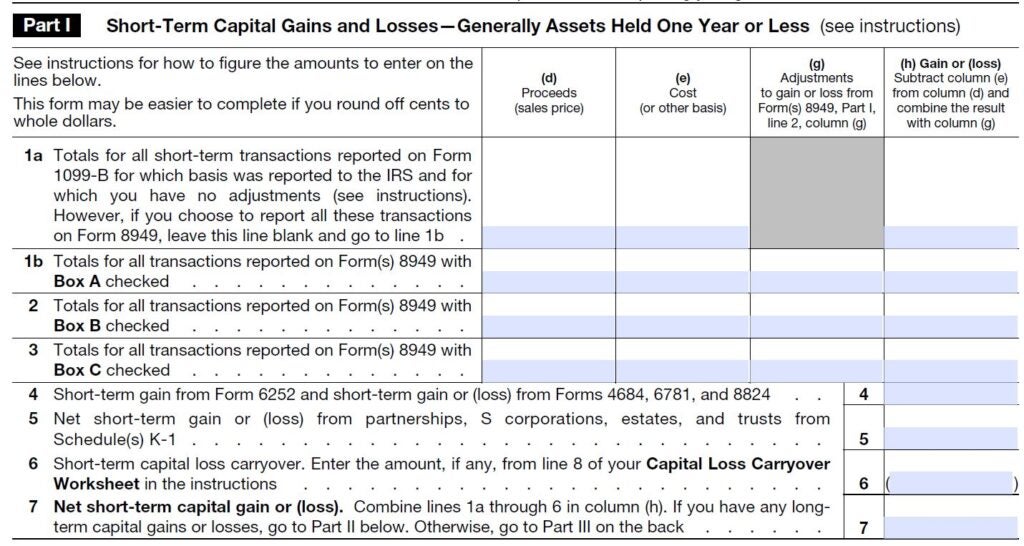

When Would I Have To Fill Out A Schedule D Irs Form

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center